Now that Elon Musk has purchased Twitter with plans to take the company private, what are the potential consequences for the fight against climate change, the crucial issue of our time? Like him or not, the Tesla CEO has arguably been the most impactful private industry actor revolutionizing clean technology. Will the purchase affect his work on clean technology?

It would be hard to overstate Musk’s value to the global decarbonization effort. His company Tesla Motors, guided by his relentless and innovative vision, has helped revolutionize the automobile industry, completely transforming it in the face of legacy automakers who made only a token effort on electric vehicles at best for decades. Now they face extinction from their inability to embrace change. Given the transportation’s sector outsized role in contributing to climate change, Musk’s role in reshaping this industry has helped give the world a fighting to chance to avoid the worst of climate impacts.

As if that’s not enough, Tesla’s work on electric vehicles has also vastly accelerated energy storage deployment of lithium ion batteries, which are central to decarbonizing the electric grid along with intermittent renewables. What’s more, Tesla now has the promise to dramatically scale up heat pumps, an important all-electric means of heating and cooling spaces. The company has improved upon them for use in vehicles, with enormous upside for expansion to buildings.

And not to mention Tesla also has a solar division. Though it has admittedly languished since Musk purchased Solar City from his cousin a few years ago, in the long run solar panels pair perfectly with home battery storage and electric vehicles for consumers.

But all of that progress could be undermined going forward by Musk’s purchase of Twitter. The specific risk for the climate change fight is that Musk might become “distracted” running Twitter (i.e. absent at critical times, with his mental energy no longer devoted to providing critical vision and direction for the company, especially since he already runs a space rocket and tunneling company). If that happens, could Tesla lose its competitive edge?

Perhaps worse, Musk’s deal to take Twitter private is heavily leveraged, and his Tesla stock provides much of the collateral. If Twitter starts to sputter (the company lost $493 million last year, and Musk himself has acknowledged that this purchase is not about making money) and Musk defaults or has to sell, will that devalue Tesla stock, depriving that company of capital for its much-needed global expansion?

On the upside, given his track record, we could assume that Musk has the potential to work some magic for a social media site plagued by controversies over free speech and how it handles misinformation. If Musk can instill more confidence among social media users across the political spectrum in Twitter, while improving debates that counter climate misinformation, perhaps Twitter can be a force for positive climate education. But given the partisan entrenchment of views on both climate policy and science, this seems unlikely to occur.

If by some miracle Musk can turn Twitter into a cash cow, then another upside is that his additional resulting wealth could help bolster not only his proven companies like Tesla but potentially provide him extra funds to invest in new clean tech start-ups that could help reduce emissions in other industries. You never know.

On balance, a better Twitter could be a positive force for society. But given Musk’s key role in the climate fight, it’s hard to see the upside for the critical clean technology we need to reduce emissions and stave off the worst of climate change.

Of course, Musk is free to do what he wants with his billions. And he’s already arguably contributed more to the climate fight than any other company leader. But in the long run, a fight over social media won’t matter much if the world doesn’t get a handle on reducing greenhouse gas emissions.

As 2021 draws to a close, I wanted to share some climate optimism. Climate and energy writer Dave Roberts interviewed carbon market analyst Kingsmill Bond, who is incredibly bullish on the long-term prospects for clean technology and bearish on fossil fuels.

In fact, he believes the world reached peak demand for fossil fuel, including coal and oil and gas, back in 2019, and that even as demand recovers, it won’t go beyond this peak. Meanwhile, clean technologies are plummeting in price and cost of deployment.

It’s worth reading the transcript of the full interview, but some highlights are below.

First, Bond notes that four of the crucial clean technologies (solar PV, wind, batteries, and electrolyzers to convert surplus electricity into hydrogen) are on established learning curves (the amount that their costs drop for every doubling in deployment) at between 16 and 34 percent. In practice, that means this already-cheap energy source is “a) going to get cheaper, b) going to spread globally, and then c) be followed up by these other technologies, also on learning curves, which will then provide us with the energy that we need at much lower cost.”

Second, he describes how fossil fuel incumbents are already pretty much on a death spiral. Specifically, he cites how legacy automakers were unprepared for the increasing shift toward new electric vehicles over old internal combustion engine (ICE) models:

You then look at the cost curves of the new stuff, and you realize that you’re going to have to change. You have to reallocate your capital out of ICE [internal combustion engine] cars and into electric vehicles. Meanwhile, you figure out that you’ve got continuous decline now coming for your ICE car sales, so suddenly, your ICE factory is a liability, not an asset. Furthermore, as your sales of ICE cars start to drop, you’ve got to allocate the same fixed-cost structure over a smaller number of cars, and your cost per unit increases. This is economics 101.

That’s what happens to the old people. What then happens to the new people, Tesla and BYD and the EV makers, is, as they produce more cars, the costs of the batteries fall because of these learning curves. As costs fall, demand increases, and as demand increases, they’re taking more market share, and they can then go to the second feedback loop, which is the financial markets.

Tesla can go to the financial markets and in an afternoon they can raise several billion dollars and build a new factory in Berlin, which increases their capacity to build at the same time the fossil fuel sector is finding it very difficult to raise capital, and is obliged by investors to change their strategic direction — as we saw, famously, with Engine No. 1.

The reason these incumbents struggle to adapt is relatively simple:

The answer is, incumbents, first of all, try and resist change. Then they struggle to put capital into these new technologies, because they’re not sufficiently profitable. You saw lots of examples of the oil center saying that over the last decade: we’re not going to put our money into solar and wind because we can get a 20 percent IRR on oil against a 5 percent IRR on solar. Why would we? The problem, then, is that by the time this stuff does get profitable and starts to eat into their old business, it’s too late, and other people have moved into this area. That’s exactly what’s happening now in the energy system.

Finally, Bond argues that the potential for cheap and abundant clean energy is massive: “If you look at the technical potential of solar and wind, which has been a lot in the last five years, it’s 100 times our global energy demand today.” It’s hard to imagine just how different our world would be if clean energy was essentially cheap and limitless.

Something to ponder as we head into the new year of 2022, with much work to be done to address climate change. May it be a good one for all of you!

This week, Ford unveiled an electric “lightning” version of its best-selling F-150 truck. Why is this potentially a big deal? This truck is America’s most popular vehicle, and has been for 40 years. Ford sold more than 203,000 F-series trucks in the first quarter of this year, compared with a combined total of 98,000 electric vehicles in the same period.

Perhaps more significantly, electric vehicles have yet to be introduced for the truck market, although Tesla, GM, and start-up Rivian all plan to introduce one. So this vehicle finally fills an important void in the market.

There are two other significant upsides to the vehicle. First, it’s relatively low priced, at least the basic model, at about $40,000. Add in $7,500 in federal tax credits, plus possibly $2,000 in saved fueling costs each year, and the vehicle is competitive with most low-end gas-powered trucks. Of course, the high-end version is almost $90,000.

Another potential upside is the fact that Ford is partnering with solar-and-battery installer Sunrun to allow the vehicle to provide backup power to homes. That means the battery in the vehicle can also power your house during outages, a topic of greater interest after recent outages in California due to wildfires and extreme heat and in Texas due to record cold. Automakers have otherwise been reluctant to provide this customer access to the vehicle’s batteries, out of concern over impact to battery life and potentially, at least for Tesla, due to its possible negative impact on sales of their stationary batteries (the PowerWall).

This added home-backup feature could help jump start competition among EV automakers to allow vehicle batteries to power buildings, which would be a good thing. It taps into an additional benefit of EVs, so consumers can assume they’re not just buying a car but a home generator. It also can help build in society-wide resilience to extreme weather and potentially help reduce grid emissions if people power their homes off the vehicle during times of electricity supply constraints that might otherwise be met by dirty power.

But two concerns remain with the F-150. First, some customers buy trucks to haul heavy stuff. But these big loads can greatly reduce battery range. Ford is trying to be transparent in calculating how weight will impact range. But given the lack of public fast-power charging infrastructure, will this inhibit sales? Truck buyers may not want to wait around 30 minutes to repower the vehicle every 100 miles, if they can even conveniently find a charging station.

Second, while the home battery backup option is intriguing, will it become functionally impractical for most consumers, if it requires expensive upgrades to building electrical panels? The truck power will require at least 80 amps of available capacity on a home service box, but most homes have between 100 and 200 amp capacity to start. So there may be little extra capacity available for wiring in a load of that size, without a costly upgrade.

We’ll have to wait and see, but it’s encouraging that a new type of electric vehicle model is now on the market. Especially one that can appeal to a much broader range of consumer, such as those in conservative states that have historically been anti-EV and generally opposed to clean energy technology. Yet it’s just the tip of the iceberg on electric trucks, as Ford will soon find itself competing head-to-head with Tesla, Rivian and GM in this lucrative e-truck market.

But at least one consumer already seems sold on the electric F-150. Here’s President Biden taking a spin on Ford’s test track this week:

President Biden yesterday unveiled his “infrastructure” plan, but it’s really his best and greatest shot to address climate change. I’ll be speaking about the plan and what it means for the climate at 10:20am PT on KQED’s Forum. You can also hear my thoughts on the electric vehicle charging aspect of the plan on yesterday’s NPR Marketplace.

The proposal calls for transformational investments in rail, bridges, and road repair, along with a decarbonized electricity grid, incentives for electric vehicles, an end to fossil fuel subsidies, and home energy retrofits, among other goals. The plan even seeks to end single-family zoning.

Tune in this morning to hear more!

Today, the Center for Law, Energy and the Environment (CLEE) at Berkeley Law and the Emmett Institute on Climate Change and the Environment at UCLA Law are releasing a new report, Data Access for a Decarbonized Grid, which highlights key policy solutions to expand access to the energy data needed to operate a fully decarbonized grid.

Join our webinar on Wednesday, April 7 at 10am PT to learn more.

As California approaches the state target of delivering 100 percent zero-carbon power by 2045, state leaders face the challenge of decarbonizing electricity by rapidly expanding the use of renewable energy sources. At the same time, they face increasingly severe heat waves and wildfires that threaten the reliability and resilience of the grid.

Individuals, businesses, and utilities are turning to a growing group of flexible grid technologies to meet this challenge—such as distributed renewables, small-scale battery storage, and smart appliances and building energy management. They are becoming increasingly mainstream and affordable. But these technologies, which facilitate the flexibility needed to deliver reliable power on a fully renewable grid, also rely on constant flows of energy data in order to operate effectively and efficiently.

The data include grid structure and operations data that depict system assets and capacity; customer-level data on consumption and rates; and real-time performance data for distributed generation and storage assets. Utilities, technology providers, and residents already exchange these data in abundant quantities. However, a set of regulatory, privacy, and incentive-based challenges limit the ability of regulators, utilities, and developers to generate and manage the data optimally.

These barriers include utility business and regulatory incentives that reward major physical capital investments over data management initiatives; potentially outdated rules restricting customer data-sharing; and concerns around cybersecurity and physical grid asset security.

To identify solutions to these challenges, CLEE and UCLA Law’s Emmett Institute convened a group of energy data experts in August 2020, and our new report details the solutions including:

- Adopting performance-based regulation of electric utilities to provide financial incentives for high-quality, efficient data generation and management.

- Re-examining the California Public Utilities Commission’s 15/15 rule for customer data aggregation (which sets numerical limits on customer cohorts) and considering use of differential privacy methods instead.

- Modernizing utility IT systems to adapt to rapidly evolving technological and customer needs.

Ultimately, a fully decarbonized electrical supply will require a large-scale restructuring of the grid across generation, distribution, and consumption activities. In the face of growing threats to grid resilience and reliability, California energy leaders will have to help energy producers and consumers throughout the state gain access to the flexible grid technologies needed to maximize efficiency and minimize service disruption. Ensuring the optimal flow of energy data is vital to that effort.

You can access the report and its full set of recommendations here.

You can also learn more about state priorities for increasing access to energy data by joining CLEE and the Emmett Institute for a free webinar on Wednesday, April 7 at 10am PT. Speakers include:

- California Energy Commissioner Andrew McAllister

- Clean energy expert Audrey Lee

- Sky Stanfield of Shute, Mihaly & Weinberger

We will discuss policy opportunities and technology needs to accelerate the transformation of the grid. RSVP here. Hope you can join!

This post was co-authored with Ted Lamm and cross-posted on Legal Planet.

With the presidential election over, Joe Biden faces a U.S. Senate that still hangs in the balance. But even with a Democratic runoff sweep in Georgia next month, it will be very divided. So what will be possible for a President Biden and his administration to achieve on climate change?

Agency action, foreign policy changes, and spending can all make a difference on emissions, with any COVID stimulus and budget deals with Congress, if feasible, providing potential avenues for further climate action. Here are some ideas along those lines, broken out by key sectors of the economy.

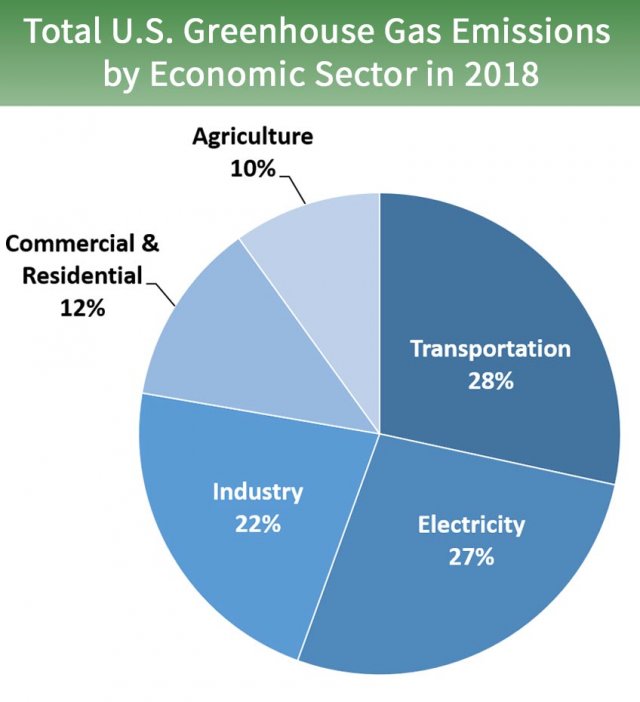

Action on Transportation

As the EPA chart above of 2018 emissions shows, transportation contributes the largest share of nationwide greenhouse gas emissions at 28%. The best way to reduce those emissions is to decrease per capita driving miles through boosting transit and the construction of housing near it, as well as switch to zero-emission vehicles, primarily battery electrics.

Transit-oriented housing is largely governed by local governments, who generally resist construction. Absent state intervention or federal legislation from a divided Congress, the Biden administration will have to make surgical regulatory changes directing more grant funds to infill housing and potentially use litigation and other enforcement tools to prevent and compensate for racially discriminatory home lending and racially exclusive local zoning and permitting practices.

On transit, a Biden administration would be very pro-rail, especially given the President-elect’s daily commuting on Amtrak in his Senate days. If the Senate flips to the Democrats, high speed rail could be a big part of any bipartisan COVID stimulus package, if it happens, which would be a lifeline to the California project that is otherwise running out of money. Other urban rail transit systems could benefit as well, and the U.S. Department of Transportation could favor and streamline grants for transit over automobile infrastructure. Notably, LA Metro CEO Phil Washington, responsible for implementing the nation’s most ambitious rail transit investment program in Los Angeles County, is chairing Biden’s transition team on transportation.

On zero-emission vehicles, Biden may have relatively strong tools to improve deployment of this critical clean technology. First, perhaps through a budget agreement with Congress, he could reinstate and extend tax credits for zero-emission vehicle purchases, which have expired for major American automakers like General Motors and Tesla. Second, he could use the enormous purchasing power of the federal government to buy zero-emission vehicle fleets. And perhaps most importantly to California, his EPA can rescind its ill-conceived attempt at a fuel economy rollback for passenger vehicles and then grant the state a waiver under the Clean Air Act to institute even more stringent state-based standards, toward Governor Newsom’s new goal of phasing out sales of new internal combustion engines by 2035.

Reducing Electricity Emissions

The electricity sectors comes in a close second place, with 27% of the nation’s greenhouse gas emissions. The move toward renewable energy, particularly solar PV and wind turbines, is so strong that even Trump had difficulty slowing it down during his single term in office, in order to favor his fossil fuel supporters. But nonetheless, the Trump administration created some strong headwinds which can now be reversed.

First and foremost, President-elect Biden can drop the tariffs on foreign solar manufacturers, which drove up prices for installation here in the United States. Second, as with the zero-emission vehicle tax credits, a budget deal with Congress could bolster the federal investment tax credit for solar, which steps down from the initial 30% toward an eventual phaseout for residential properties and 10% for commercial properties. The credit could also be extended to standalone energy storage technologies, like batteries and flywheels, if Biden budget negotiators play their hands well (easy for me to say). A Biden administration could also improve energy efficiency by dropping weak regulations on light bulbs and appliances like dishwashers at the U.S. Department of Energy and introducing more stringent ones instead.

Legislatively, any COVID stimulus deal (again, if it happens) could potentially contain money for a big renewable energy buildout, including for new transmission lines, grid upgrades, and technology deployment. In terms of regulations, if Biden is able to get any appointments through the Senate to agencies like the Federal Regulatory Energy Commission (FERC), that agency could make climate progress by simply letting states deploy more renewables and clean tech, including demand response, as well as potentially supporting state-based carbon prices (a move supported by Trump’s FERC appointee Neil Chatterjee, which promptly resulted in his demotion last week).

Slowing Fossil Fuel Production

The two big moves for the Biden administration will be to stop new leases for oil and gas production on public lands (including immediately restoring the Bear’s Ears and Grand Staircase-Escalante national monuments) and bringing back the methane regulations on oil and gas producers that the Trump administration rolled back. As a bonus, his Interior Department could engage in smart planning to deploy more renewable energy on public lands, where appropriate, including offshore wind.

Other Climate Action

The list goes on for how the Biden administration can embed smart climate policy into all agencies and facets of government, with or without Congress. Of particular note, his appointees at financial agencies like the Federal Reserve and U.S. Securities and Exchange Commission could bolster and require climate risk disclosures for institutional and private investors. The U.S. Office of Management and Budget could ramp back up, based on the best science and economics, the social cost of carbon, which represents the cost in today’s dollars of the harm of emitting a ton of carbon dioxide equivalent gas into the atmosphere. This measure provides much of the economic justification for the federal government’s climate regulations. And of course, President-elect Biden can have the U.S. rejoin the 2015 Paris climate agreement immediately upon being sworn in (though the country will need to set a new national target).

Overall, Biden’s win means the U.S. will regain some climate leadership at the highest levels, with much that can be done through congressional negotiations, agency action, and spending. However, the stalemate in the US Senate likely means that any hopes for big new climate legislation will be dashed. As a result, continued aggressive action at the state and local level, as well as among the business community, will be critical to continue to help push the technologies and practices needed into widespread, cost-effective deployment to bring down the country’s greenhouse gas footprint.

One election certainly won’t solve climate change, and the costs continue to rise to address the impacts we’re already seeing from extreme weather. But given the current political climate, the actions described above could allow the U.S. to still make meaningful progress to reduce emissions over the next four years and beyond, even in an era of divided government.

Jim Mahoney was perhaps an unlikely climate hero. A senior Bank of America and FleetBoston Financial executive for 25 years who tragically passed away this past weekend at the age of 67 (the result of complications from injuries he sustained in a bicycle accident last year), Jim’s work focused on global corporate strategy and public policy for a major financial institution. Climate change would have been just one component of his portfolio of issues affecting banking.

But back in 2008, Jim teamed up with his former boss, then-California Attorney General Jerry Brown, to make a difference on climate policy. Brown and Mahoney, through Brown’s then-climate advisors Ken Alex (now with Berkeley Law) and Cliff Rechtschaffen (now a California public utilities commissioner), approached Rick Frank (now with UC Davis Law) and Steve Weissman (now with the Goldman School) at UC Berkeley Law and Sean Hecht and Cara Horowitz at UCLA Law to launch a Climate Change and Business Initiative at the law schools.

The initiative was only planned for one year, to focus on then-emerging topics in climate policy like infill housing, small-scale renewable energy, low-carbon agricultural practices, and residential energy efficiency financing. The idea was to convene small groups of experts for roundtable discussions that would inform policy reports on business solutions to reduce greenhouse gas emissions. These reports in turn would ideally educate California legislators and regulators on cutting-edge, consensus climate solutions.

But with Jim’s quiet but committed leadership at Bank of America, that one-year initiative soon grew to a multi-year program that has to this day covered multiple climate and clean energy issues and influenced legislation and regulation in California and throughout the country. Here are just a few highlights:

- Pioneering climate and clean energy legislation: The initiative helped inform the California’s first-in-the-nation energy storage mandate, which proved so successful that the initial targets have been increased and expanded. It also inspired legislation to streamline permitting for utility-scale solar PV on degraded agricultural land, as well as to increase California’s renewable energy requirements.

- Regulation and funding: Recent work on boosting energy retrofits for low-income multifamily buildings was incorporated into state energy planning, while a biofuels convening helped steer millions of dollars of state energy funding for this low-carbon industry.

- Inspiring out-of-state action: A number of the in-state policy recommendations have informed similar work elsewhere, such as our stakeholder process to identify prime areas for renewable energy development. And in general, California legislation on climate and energy has inspired similar action across the United States, particularly on renewable energy and zero-emission vehicles.

- Cataloguing climate solutions: All of the initiative’s recommendations over the years are compiled in the easy-to-use website climatepolicysolutions.org.

- Influencing public debate: In addition to convenings and reports, the initiative has led to publication of numerous op-eds (most recently on ways to make the electricity grid more resilient and low-carbon), webinars (such as on priority climate solutions with California’s top climate leaders), and conferences (including recently on expanding zero-emission freight technologies at Southern California’s ports).

- Training future climate leaders: Throughout the research involved with this initiative, the law schools have included numerous law students and recent graduates to help conduct that work. Many of them have gone on to further this work through their professional employment at law firms, clean technology companies and government agencies, among others, with one recent fellow now advising the Biden campaign on climate policies.

And on a personal note, Jim’s initiative provided me with an opportunity to dedicate my career to working on all of these important issues, as I was first hired at Berkeley Law for that one-year initiative before eventually directing the climate program at the law school’s Center for Law, Energy and the Environment (CLEE).

While many individuals have been involved in the Climate Change and Business Initiative over the years, none of this work would have been possible without Jim’s leadership at Bank of America. Along with his colleagues, including Rich Brown, Brian Putler, Kaj Jensen, Alexandra Liftman, and others, Jim ensured that the initiative had strong institutional support and funding to carry out this work, without ever interfering or trying to influence the content of what the initiative covered or recommended. Quite the opposite, he helped the law schools’ harness the Bank’s expertise and contacts to further the dialogues and reach of the findings.

Jim’s death is a blow to his family, friends, colleagues, and those of us who care about the issues he helped advance. The Boston Globe published a worthy tribute to his career and extensive family, including his volunteer stint driving then-presidential candidate Jerry Brown around New Hampshire and Wisconsin.

Jim will be missed, but his legacy of climate leadership will live on in the work and policies he helped advance, and in the lives he touched. May he rest in peace.

On January 27, 2017, just one week after Trump’s inauguration, UC Berkeley Law’s Henderson Center for Social Justice held a daylong “Counter Inauguration,” featuring various panels in reaction to Trump’s victory. I spoke on an afternoon panel that day entitled “Monitoring the Environmental, Social and Governance Impacts of Business in the Trump Era” and offered my predictions on what the Trump years would bring for environmental law and policy.

I recently reviewed these predictions, three months out from the upcoming November election, to see how they measured up against the reality of Trump’s near-complete term in office. Bottom line: these predictions mostly tracked with what happened with Trump and his administration’s leaders, albeit with some steps I missed, some that never came to pass, and some positive outcomes for environmental protection.

First, I predicted the Trump Administration would follow through on the campaign pledges to boost fossil fuels in the following ways:

- Opening up public lands for more oil and gas extraction

- Slashing regulations that limit extraction and related pollution, such as the Clean Power Plan and methane rules

- Weakening fuel economy rules for passenger vehicles

- Financing more infrastructure that could boost automobile reliance (i.e. more highways and less transit)

These were all relatively predictable actions, and they all pretty much happened as predicted. On public lands and fossil fuels, Trump rolled back National Monument protection at Utah’s Bears Ears and Grand Staircase-Escalante, as well as streamlined permitting for oil and gas projects on public lands. On environmental rules in general, here is a list of 100 environmental regulations that the administration has tried to reverse. On vehicle fuel economy standards, here’s my article on EPA’s proposed rollback. And transit funding went from 70 percent of transportation grants under Obama to 30 percent under Trump, with the rest funding highways.

Second, I predicted that his administration would try to undermine clean technologies by:

- Weakening tax credits for renewables and electric vehicles

- Undoing federal renewable fuels program

- Revoking California’s ability to regulate tailpipe emissions

- Attempting to undermine California’s sovereignty to regulate greenhouse gases through legislation

- Cutting funding for high speed rail and urban transit

- Withdrawing from Paris agreement

On these predictions, I was correct on most accounts. The administration did weaken tax credits for renewables (both by not extending them or preventing them from decreasing over time, save for a recent one-year extension on wind energy as a budget compromise) and electric vehicles (by letting them expire and threatening to veto Democratic legislation that would have extended them in a recent budget bill). His EPA did revoke California’s waiver to issue tailpipe emission standards. And he famously withdrew from the Paris agreement (to take actual effect later this year) and has tried to cancel almost $1 billion in high speed rail funding in California.

But I was incorrect that the administration would pursue legislation to preempt California’s (and other states’) sovereignty to set their own climate change targets. There was little appetite in Congress to do so, though Trump’s Justice Department did seek unsuccessfully to declare California’s cap-and-trade deal with Quebec to be unconstitutional. And his record on renewable fuels is more mixed but did deliver some gains to corn-based ethanol producers, though the environmental benefits are suspect with this type of biofuel. I also failed to predict the administration’s efforts to impose tariffs on foreign solar PV panels and wind turbines, which slowed those industries somewhat.

Finally, I predicted some possible bright spots for the environment in the Trump years, much of which did occur:

- Clean tech generally has bipartisan support in congress

- Infrastructure spending in general could be negotiated to benefit non-automobile investments

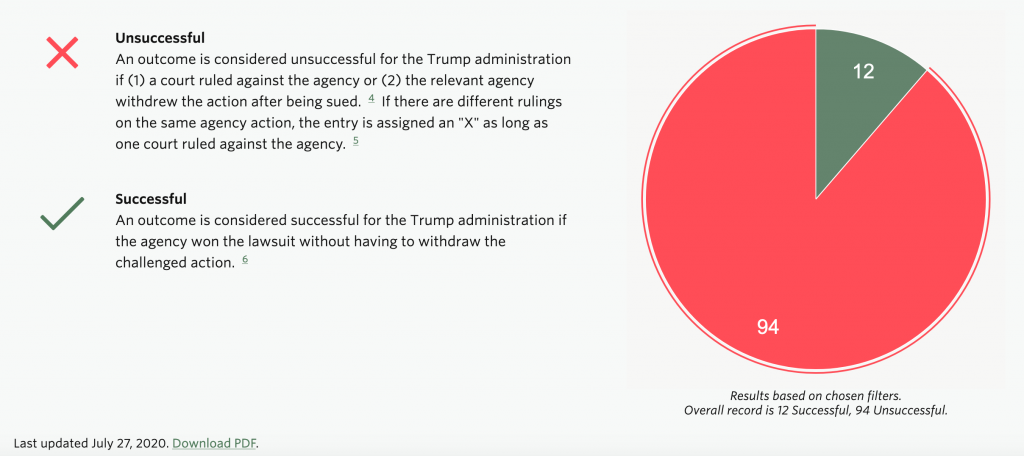

- Lawyers can stop or delay a lot of administrative action on regulations

- A shift will happen now to state and subnational action on climate, which probably needed to happen anyway

Sure enough, clean technology, particularly solar PV, wind and batteries, has continued to increase in the Trump years, though not at the same pace as under Obama due to the policy headwinds. But infrastructure spending has definitely favored automobile interests, as noted above.

But more importantly, two critical predictions did come to pass. First, attorneys have successfully stopped most administrative rollbacks. In fact, the administration has an abysmal record defending its regulatory actions in court. As NYU Law’s Institute of Policy Integrity has documented, the administration has lost 94 cases in court and won only 12 to date, as tracked in this chart:

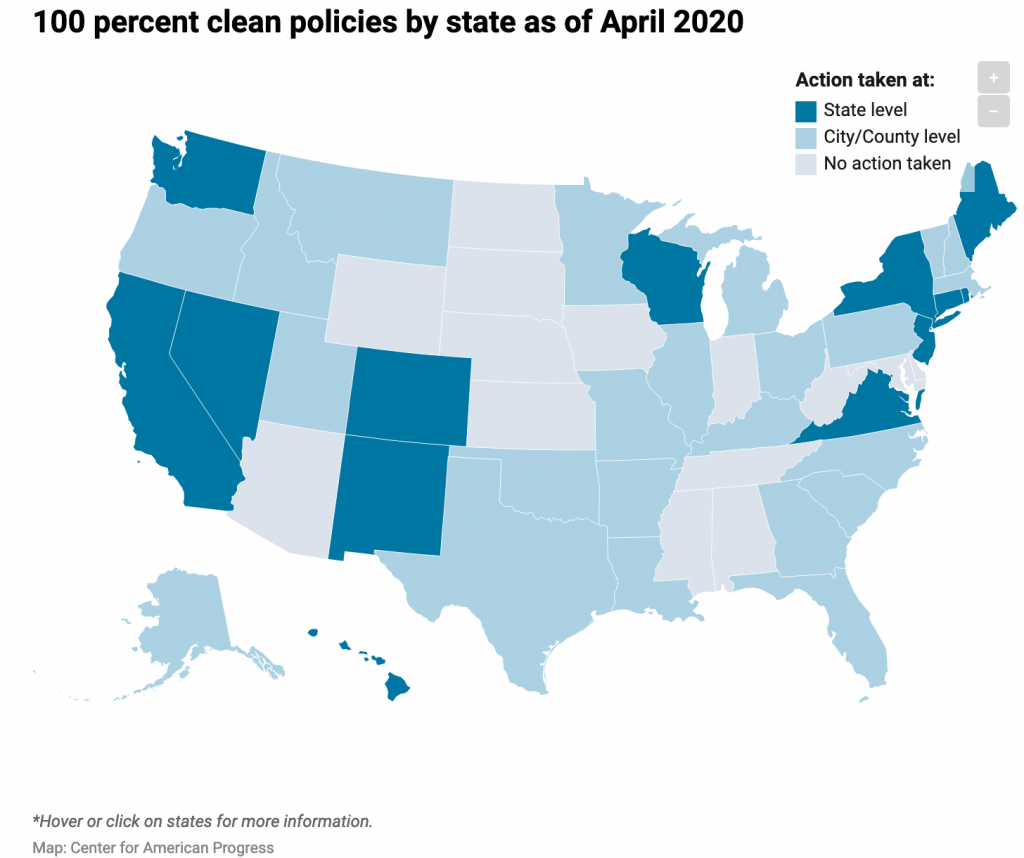

And perhaps more importantly, the lack of federal climate action has moved the spotlight to state and local governments, which often have significant sovereignty to enact aggressive policies that add up to serious national climate action. Take renewable energy, for example, per the Center for American Progress, with this map of states and municipal governments that have enacted 100% clean electricity standards:

And on clean vehicle standards, 13 states plus the District of Columbia now follow California’s aggressive zero-emission vehicle standards, representing about 30 percent of the nation’s auto market.

As a result, in many ways, environmental law and climate action appears to have survived the Trump term in office mostly intact, despite losing progress and facing some setbacks on key issues. Most of the regulatory actions can be reversed by a new administration, while Congressional action during the Trump years was relatively minimal in scope. Meanwhile, the counter-reaction to Trump spurred some significant policy wins at the state and local level.

But while one term is perhaps survivable for environmental law and climate progress, a second one could paint a completely different picture. So the stakes certainly remain high this November.

California law under SB 100 (De León, 2018) requires that our electricity system run on 100% carbon-free power by 2045. That means a significant deployment of energy storage resources, like batteries, to capture surplus renewable power from the sun and wind for dispatch during dark and windless times.

While passing this law was a milestone, actually achieving this target will require siting and permitting major clean energy facilities. And perhaps no better land is appropriate for these facilities than at existing fossil fuel plants. These plants are on already-industrialized land with access to transmission lines. Converting them to energy storage facilities is a double-win: it offers a phase out of fossil fuels, while improving the air quality (and often the aesthetics) of the surrounding area.

So that’s why it’s frustrating to see one such proposed conversion to battery storage — the Moss Landing power plant battery energy storage project — potentially held up for months now by local opposition. The Monterey County Planning Commission will consider the project at its July 29th hearing.

The proposed project involves a 1,200-megawatt (MW) battery energy storage system, fit into the existing industrial footprint of the Moss Landing power plant in four two-story buildings, along with associated infrastructure (substations and inverters/converters). It will also replace existing lattice transmission towers with monopoles (staff report available here).

Most importantly, the goal of the project is to store renewable energy from the sun and wind to help California decarbonize its electricity grid. For this reason, Pacific Gas & Electric (PG&E, the local utility) selected the project and brought it to the California Public Utilities Commission for approval, with a condition that the project reach commercial operation by July 18, 2021 (PG&E advice letter here).

But a good proposal to support needed climate policy is not always enough in California. Permitting any industrial project comes with challenges and opposition, most notably compliance with environmental review under the California Environmental Quality Act (CEQA).

In this case, a review of the project under CEQA by the county revealed no significant impacts on the myriad study areas, including air quality, biological resources, water, traffic, cultural resources, and others; provided the developer implement appropriate mitigation measures. However, the developer ended up going beyond the county’s recommendations by committing to a dialogue process to identify additional mitigation measures to protect migratory birds. In short, the developer agreed to go above and beyond what CEQA requires.

Furthermore, in collaborating with the National Audubon Society and Monterey Audubon, the developer agreed not to include new transmission poles and high-voltage wires until after 2020, at which point they will conduct final design in consultation with those nonprofits. The company further committed to addressing bird safety issues in that process, including consideration of undergrounding high-voltage transmission wires.

Ultimately, the clean energy nature of the project, the county’s preparation of an environmental review document that follows CEQA, and this additional commitment to address bird safety issues were enough to gain the support of Audubon and the Sierra Club. The project appeared to face relatively easy sailing to a permit, but the planning commission delayed considering it at its July 8th meeting so that the environmental review document could be revised to clarify transmission wire placement associated with the project. Hopefully, the commission approves the project on July 29th, and no one appeals it to the Monterey County Board of Supervisors.

If California can’t allow relatively straightforward permitting of energy storage facilities at existing power plants with minimal anticipated impacts, where can they go? Not only will clean tech companies shy away from investing in California, potentially driving up costs from lack of competition, but these eyesore power plants may take longer to decommission. In the case of Moss Landing, the power plant has 500-foot dual smokestacks visible through Monterey Bay, a source of visual blight and air pollution in an otherwise unique marine and coastal environment. This battery storage project could help facilitate this decommissioning sooner rather than later, while embodying precisely the critical energy storage deployment California needs to achieve a decarbonized future.

Building a low-carbon economy will rely on a transition from gasoline-powered automobiles to electric vehicles, which will require a significant increase in production of component minerals. Extracting and refining these minerals, like cobalt and lithium, can often entail challenges related to governance, human rights, and environmental quality in host countries.

To help launch a forthcoming CLEE and Natural Resource Governance Institute (NRGI) report on this topic, join our upcoming webinar on Thursday, July 23rd, at 9am PT/noon ET/6pm CET. Panelists will discuss mechanisms to address sustainability concerns and build a better supply chain for this key emission reduction technology, as well as summarize findings from the new report.

Speakers include:

- Patrick Heller, Senior Visiting Fellow, Center for Law, Energy & the Environment (CLEE) & Advisor, Natural Resource Governance Institute (NRGI)

- Michael Maten, Automotive Public Policy, Electrification, Portfolio Planning and Strategy, General Motors

- Daniel Mulé, Senior Policy Advisor for Tax and Extractive Industries, Oxfam

- Payal Sampat, Mining Program Director, Earthworks

You can register here and read our recent FAQ on EV batteries for more information on current supply chain impacts on human rights, climate change and the local environments.