Gas prices have been on the rise, reaching a high not seen since summer of 2015:

The price increases could have both a positive and negative effect on California and the country’s transportation politics and climate policies.

First, let’s look at the price increases, which have been volatile and uneven. As the Wall Street Journal reported last week:

“The crude complex has seen prices stall a bit near recent highs as the market weighs whether a rising tide of geopolitical risk and strong demand is enough to continue overshadowing U.S. production growth to force prices steadily higher,” said analysts at Schneider Electric.

But analysts expect price declines to remain limited: the potential loss of Iranian oil from global markets might open up extra space for U.S. exports, while the market has already tightened due to falling Venezuelan output, worldwide economic growth and production curbs from OPEC members.

If the price rise lasts, it could affect some key transportation policies and efforts to decarbonize driving. On the positive side for the environment, high gas prices could:

- Boost battery electric vehicles: higher gas prices will encourage people to buy more fuel-efficient vehicles, particularly electric vehicles. That’s an all-around win for the environment and long-term efforts to transition away from fossil fuels.

- Reduced vehicle miles traveled: higher gas prices mean people will be less likely to drive as much, reducing emissions in the process and making it easier to meet our climate goals and decreasing the demand for outlying sprawl housing.

But on the negative or mixed side, higher prices could:

- Help California’s gas tax repeal measure: the California Legislature took a courageous step last year when they voted as a super-majority to increase the gas tax to pay for transportation infrastructure maintenance. Republicans have now put the tax on the November ballot as a voter-initiated repeal measure, hoping it will energize their base to come out to vote. High gas prices in November could give this measure real political life (although I’d rather see legislators investigate possible oil industry price manipulation instead).

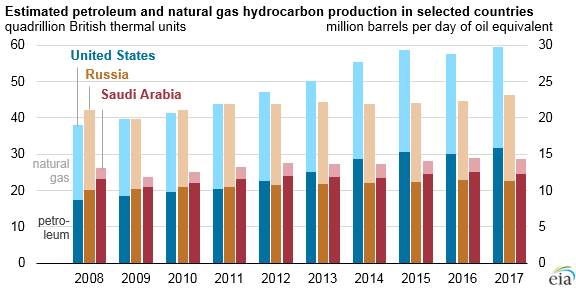

- Possibly reduce economic output with less money for investment in clean technology: high gas prices could potentially depress sectors of our economy, which could dampen investment in clean technology generally and undermine political will to tackle environmental problems. But high gas prices in the U.S. cut both ways: while it hurts consumers, it helps oil and gas producers. And in the U.S., we’re among the global leaders in fossil fuel production, as this EIA chart shows:

So high gas prices could boost oil-producing states and the economy for those residents, which could have varied effects on those states’ willingness to pursue clean transportation policies (although admittedly probably minimal, as many of these states are dominated by Republicans and unlikely to support pro-clean tech policies anyway).

Overall, high gas prices could be a political win for most clean transportation policies and technologies, but with some potentially negative consequences as well.

A bipartisan super-majority of California legislators took a courageous step this year to pass SB 1 (Beall), which raises the gas tax and vehicle license fees to help pay for backlogged repairs to our crumbling transportation infrastructure. Opponents are now mobilizing for a recall campaign against state senator Josh Newman of Orange County over the vote and to repeal the legislation by voter initiative.

A bipartisan super-majority of California legislators took a courageous step this year to pass SB 1 (Beall), which raises the gas tax and vehicle license fees to help pay for backlogged repairs to our crumbling transportation infrastructure. Opponents are now mobilizing for a recall campaign against state senator Josh Newman of Orange County over the vote and to repeal the legislation by voter initiative.

But UC Berkeley energy economist Severin Borenstein makes the case that the gas tax increase may pale in comparison to possible price gouging by the oil industry:

It’s been 32 months now, and Californians continue to pay at least 20 cents per gallon more than our higher taxes, greenhouse gas fees (cap and trade and the low-carbon fuel standard), and production costs could explain. Throughout that time, I was a member of the California Energy Commission’s Petroleum Market Advisory Committee, a panel of independent energy market experts, and I chaired the committee starting in August 2015.

The PMAC issued its final report last month. It highlighted the unexplained price premium … that has hit Californians since mid-February 2015, amounting to $12 billion — or $1,200 for a typical family of four — in excess payments over the last two and a half years. Those extra payments continue today at a rate of about $3 billion per year, nearly twice the cost of Wednesday’s gas tax increase.

And unlike the extra tax revenue, this money is not going to fix any roads or bridges.

When Borenstein’s state-organized committee tried to make recommendations to investigate the surcharge, they got nowhere with the legislature:

The PMAC discussed both profiteering and infrastructure constraints on production and imports. But the final report concluded that the committee had been given neither the authority, nor the resources, to fully investigate and determine the cause of the mystery surcharge. The committee had no budget allocation, was assigned less than one full-time staff person, and had no power to compel cooperation from industry.

The committee urged the State to commit serious time and resources to unpack the reasons for the new normal of higher payments to gasoline sellers. So far, there is no sign of an appetite in Sacramento for such an investigation, even as we re-argue the case for and against increasing gas taxes to maintain roads and bridges.

So perhaps the real scandal here isn’t the legislature’s efforts to address our crumbling roads, bridges and transit systems — but rather it’s unwillingness to find out why the oil industry is charging California drivers so much for gasoline.

And in the meantime, California drivers (at least those who aren’t driving electric) are paying the price for this inaction.

Last week the California legislature did what many have been hoping for at the national level: pass an infrastructure bill. The issue was the state’s nearly $60 billion backlog in deferred maintenance for our transportation infrastructure.

Last week the California legislature did what many have been hoping for at the national level: pass an infrastructure bill. The issue was the state’s nearly $60 billion backlog in deferred maintenance for our transportation infrastructure.

But rather than deficit spend or raid other programs, the legislature took a politically brave step with SB 1 (Beall) of raising gas taxes and vehicle registration fees to pay for this work. It took a two-thirds super majority, which meant no room to spare on votes.

From an environmental perspective, the plan is good because it generally doesn’t pay for new capacity, just repairs and maintenance of existing infrastructure. The money will also help fund transit and bicycle and pedestrian infrastructure.

Environmentalists complained about a weakening of standards for truck drivers to retrofit or retire their dirtiest vehicles, but those impacts could potentially be blunted by tightening other environmental standards related to fuels and pollution limits. Some also objected to the new annual electric vehicle fee ($100) per year, which could discourage consumer adoption. But that fee seems relatively modest for vehicles that contribute to wear-and-tear on the roads.

The primary criticisms of the plan boiled down to the following:

1) California should spend its existing dollars more efficiently. Republicans and even one Democrat took this approach, arguing that “Caltrans reforms” could save us an equivalent amount of money. However, none of them to my knowledge spelled out exactly how much money could be saved and how from these reforms. I also don’t know of any study that has attempted to quantify potential savings. As a result, this criticism struck me as ideological posturing, along the lines that eliminating foreign aid and welfare could help balance the federal budget, when those programs are a mere pittance compared to military and insurance spending.

2) California should devote high speed rail money to deferred maintenance instead of funding this unpopular train project. Democratic state senator Steve Glazer made this argument, which is uninformed and inaccurate. High speed rail is funded by state bond money, approved by the voters, that cannot legally be diverted to other uses. Additional federal dollars are also reserved solely for train projects. Some cap-and-trade auction proceeds are directed to high speed rail and could theoretically go to other transportation uses, but these are only a few billion dollars at this point, hardly anywhere close to the $60 billion we need. Plus, those funds should go to projects that reduce greenhouse gas emissions, which high speed rail will do once it’s built and operational, whereas highway investments have the opposite impact.

3) California should find the money from existing transportation revenues that are instead spent on the general fund or other non-transportation sources. I’m admittedly less familiar with how transportation revenues are spent in the state, and in concept I would support efforts to ensure that dollars collected from transportation go to transportation improvements. But the critics, to my knowledge, presented no hard numbers on how much could be redirected to address the funding needs. So it was hard to take this criticism too seriously.

4) Californians already are overtaxed on transportation. Not when it comes to the gas tax and spending for road maintenance. The existing state and federal gas taxes have not kept up with inflation, and as vehicles become more fuel efficient, the revenues will continue to fail to keep up with usage. In short, most drivers are actually getting a cheap ride when it comes to paying for their fair share of road repair, minus the bills they have to pay to repair their cars from hitting potholes.

Overall, it’s an important spending bill that should help the environment to some extent, while also providing a fiscal stimulus in rural communities through the repair work. Higher gas taxes could also marginally dissuade people from buying gas guzzlers, although the taxes are relatively minimal compared to the price of gasoline.

But don’t expect this kind of action at the federal level, barring unlikely bipartisan cooperation with the Trump administration. Because raising taxes and fees isn’t popular, and it takes courage to do so when the need is great. And that kind of courage and foresight is in short supply at the federal level.