I’m guest hosting Your Call’s Media Roundtable this morning at 10am PT. We’ll start by covering the ongoing university crackdowns on pro-Palestinian protesters and their encampments. What’s the latest from our country’s campuses? We’ll be joined by:

- Hoda Sherif, Journalist receiving her master’s degree at Columbia’s Graduate School of Journalism, and

- Lara-Nour Walton, reporting deputy of audio at Columbia Daily Spectator.

Then we’ll discuss the move among many states to restrict public protests in general, with Adam Federman, reporting fellow with Type Investigations and author of Fasting and Feasting: The Life of Visionary Food Writer Patience Gray.

Tune in at 91.7 FM in the San Francisco Bay Area or stream live at 10am PT. What comments or questions do you have for our guests? Call 866-798-TALK to join the conversation!

I’m guest hosting Your Call’s One Planet Series this morning at 10am PT. We’ll discuss Until the End of the World, a new documentary that investigates the fast-growing fish farming industry across three continents.

The film exposes how communities in different regions are fighting against the expansion of these fish farms, which are accused of polluting pristine waters, overtaking natural resources, and even fostering hunger and food insecurity.

Aquaculture is the fastest growing food industry in the world, promising to be a sustainable solution to feed a growing global population that could reach 9.7 billion people in 2050. But is this industry a viable and sustainable answer for food security?

Joining us will be Francesco De Augustinis, the award winning journalist and filmmaker, and the founder of One Earth.

Tune in at 91.7 FM in the San Francisco Bay Area or stream live at 10am PT. What comments or questions do you have for our guests? Call 866-798-TALK to join the conversation!

I’m guest hosting Your Call’s Media Roundtable this morning at 10am PT. First, we’ll discuss the coordinated campaign by fossil fuel interests and their allies to sow disinformation about renewable energy. I’ll interview Rebecca Burns, an award-winning investigative reporter who has covered this story extensively.

Then, we’ll discuss the one-year anniversary of the civil war raging in Sudan. Joining me will be Sudanese-American journalist Isma’il Kushkush, who has reported on the conflict from the beginning.

Tune in at 91.7 FM in the San Francisco Bay Area or stream live at 10am PT. What comments or questions do you have for our guests? Call 866-798-TALK to join the conversation!

On tonight’s State of the Bay on KALW, we’ll sit down with Corrina Gould of the Sogorea Te’ Land Trust to learn about a historic new agreement that will transfer a sacred Native American site in Berkeley back to the indigenous Ohlone people.

Then, we’ll discuss a California survey designed to understand and address the needs of the LGBTQIA+ community as they age. We’ll be joined by Susan DeMarois, Director of the California Department of Aging, and Openhouse Executive Director Kathleen Sullivan.

Finally, we’ll meet Allegra Madsen, the new Executive Director of the Frameline film festival, which celebrates queer storytelling.

Tune in at 91.7 FM in the San Francisco Bay Area or stream live at 6pm PT. What comments or questions do you have for our guests? Call 866-798-TALK to join the conversation!

On tonight’s State of the Bay, I’ll talk with Joe Eskenazi, Managing Editor of Mission Local, about the results of the March 5th Election and what they mean for San Francisco.

Then, I’ll interview three experts about whether climate disclosure and emissions requirements will be effective and what the prospects are for divestment from fossil fuels. The panel will include:

- Dave Jones, Director of the Climate Risk Initiative at UC Berkeley’s Center for Law, Energy and the Environment (CLEE)

- Rev. Kirsten Snow Spalding, Vice President of the Ceres Investor Network

- Malin Clark, Partner at Third Economy, a sustainability consulting firm

Finally, we’ll hear about the all-girl robotics team, The Janksters, and their robot Rosa! Joining me will be their coach, Marta Carrillo.

Tune in at 91.7 FM in the San Francisco Bay Area or stream live at 6pm PT. What comments or questions do you have for our guests? Call 866-798-TALK to join the conversation!

I’ll be a guest on KQED Forum at 10am PT today discussing how to improve electric vehicle charging infrastructure in California.

Electrical vehicle purchases in the state dropped significantly in the second half of last year, for the first time in a decade. It’s likely this is just a blip, but some potential EV buyers say that they’re holding off because of concerns over public charger access and reliability.

The situation may be improving though: California approved a $1.9 billion dollar investment in EV charging infrastructure last month, which will bring 40,000 new chargers online – including in rural areas.

On the show, I’ll talk about what California needs to do to meaningfully expand its EV charging infrastructure ahead of its 2035 ban on the sale of new gas-powered cars. Joining me on the panel will be:

- Russ Mitchell, Automotive Editor, Los Angeles Times, who covers the automotive industry.

- Terry Travis, managing partner, EVNoire, a Mobility Consulting Group that works to integrate and amplify diversity, equity, and inclusion in the electric transportation sector.

Tune in on KQED 88.5 FM in the San Francisco Bay Area or stream live at 10am PT!

Last week, the California Public Utilities Commission approved Waymo’s expansion of autonomous taxi service into communities south of San Francisco and in Los Angeles. Notably, the list of supporters included many organizations committed to enhancing safety for people who walk and bike, as well as disability advocates. That tells me they understand that robot drivers are much safer than human drivers.

In opposition were a number of city and county leaders in the expansion zones. That tells me that Waymo and its supporters need to do a lot more outreach with local government leaders to explain how their technology interacts with existing municipal services, from waste haulers to fire safety vehicles.

I spoke to KTVU news about the decision and its basis in California law:

Ultimately this expansion signals that a driverless future is already here and growing, with companies like Waymo believing that there’s a profit to be made from it. And despite some high-profile malfunctions, this future promises to be a safer one than the status quo.

In honor of Black History Month on tonight’s State of the Bay, we’ll have two segments highlighting the Black community. First, did you know the average white family has eight times the wealth of the average Black family? We will examine this racial wealth gap and how impact investing might be a solution with:

- UC Berkeley Law Professor and Director of the Othering and Belonging Institute’s john a. powell

- Daryn Dodson of Illumen Capital

- Toussaint Bailey of Uplifting Capital (and also my UCLA Law classmate)

Second, we’ll talk to Nia McAllister from the Museum of African Diaspora (“MoAD”) about the museum’s latest exhibitions celebrating the Black experience.

And to kick off the show, we’ll hear from San Francisco Chronicle reporter Aldo Toledo about what’s at stake in the upcoming March 5th election.

Tune in at 91.7 FM in the San Francisco Bay Area or stream live at 6pm PT. What comments or questions do you have for our guests? Call 866-798-TALK to join the conversation!

On tonight’s State of the Bay, we’ll play Monday night quarterback with Steve Berman, the “Bay Area Sports Guy” at The Athletic, who will provide analysis of the San Francisco 49ers loss in the Super Bowl yesterday, plus his latest on the Warriors and the A’s.

Then we’ll discuss how Marin County is consistently ranked as the #1 healthiest county in California, but with one notable exception: when it comes to underage substance use, Marin’s rate is nearly twice the state’s average. Adolescent psychiatrist Dr. Emily Tejani and Dr. Matt Willis, Marin county’s public health officer, will talk more about the problem and offer some potential solutions.

Finally, we’ll hear all about George McCalman’s book Illustrated Black History: Honoring the Iconic and Unseen.

Tune in at 91.7 FM in the San Francisco Bay Area or stream live at 6pm PT. What comments or questions do you have for our guests? Call 866-798-TALK to join the conversation!

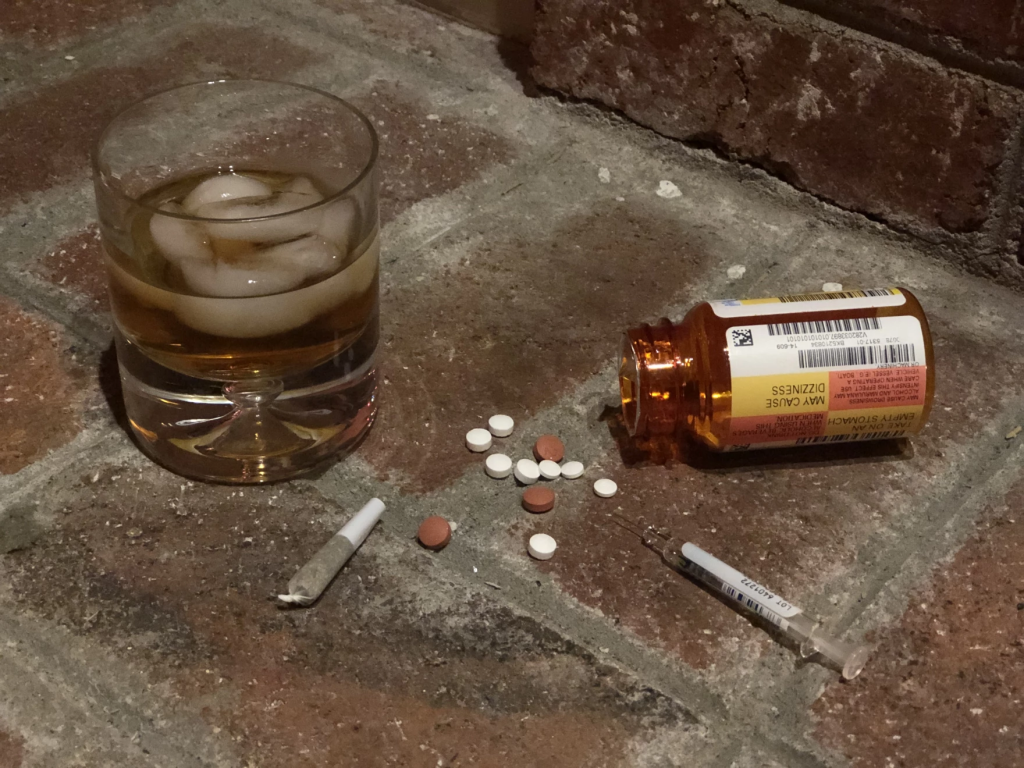

2023 was San Francisco’s deadliest year on record for drug overdoses. More than 800 residents lost their lives to accidental overdoses last year, and nearly 80% of those deaths were linked to the synthetic opioid fentanyl. Tonight on State of the Bay, I’ll host a panel of experts who will discuss what should be done to address addiction and prevent more loss of life in our city.

Joining me will be:

- Vitka Eisen, president and CEO, HealthRIGHT 360

- Kevin Fagan, reporter, The San Francisco Chronicle

- Dr. Anna Lembke, professor of psychiatry, Stanford University School of Medicine; chief, Stanford Addiction Medicine Dual Diagnosis Clinic; author, Drug Dealer, MD – How Doctors Were Duped, Patients Got Hooked, and Why It’s So Hard to Stop and Dopamine Nation: Finding Balance in the Age of Indulgence

Finally, we’ll learn about Rancho-Obi Wan, the largest Star Wars memorabilia collection in the country, from the collector Steve Sansweet.

Tune in at 91.7 FM in the San Francisco Bay Area or stream live at 6pm PT. What comments or questions do you have for our guests? Call 866-798-TALK to join the conversation!